Is the price going down in the short term? Or is there a staged rebound? It is also necessary for the market to continue to digest the recent hedging news. The real estate market data continues to be pessimistic, coupled with the beginning of late May, will usher in a seasonal off-season. On the one hand, the current continuous windy weather in the north, and on the other hand, the advent of the rainy season in the south will restrict demand, but many places are still actively introducing policies to stimulate the improvement of the real estate market, which is expected to have a landing effect in the later stage. The hot coil market is currently facing the current situation of weak domestic demand and reduced external demand.

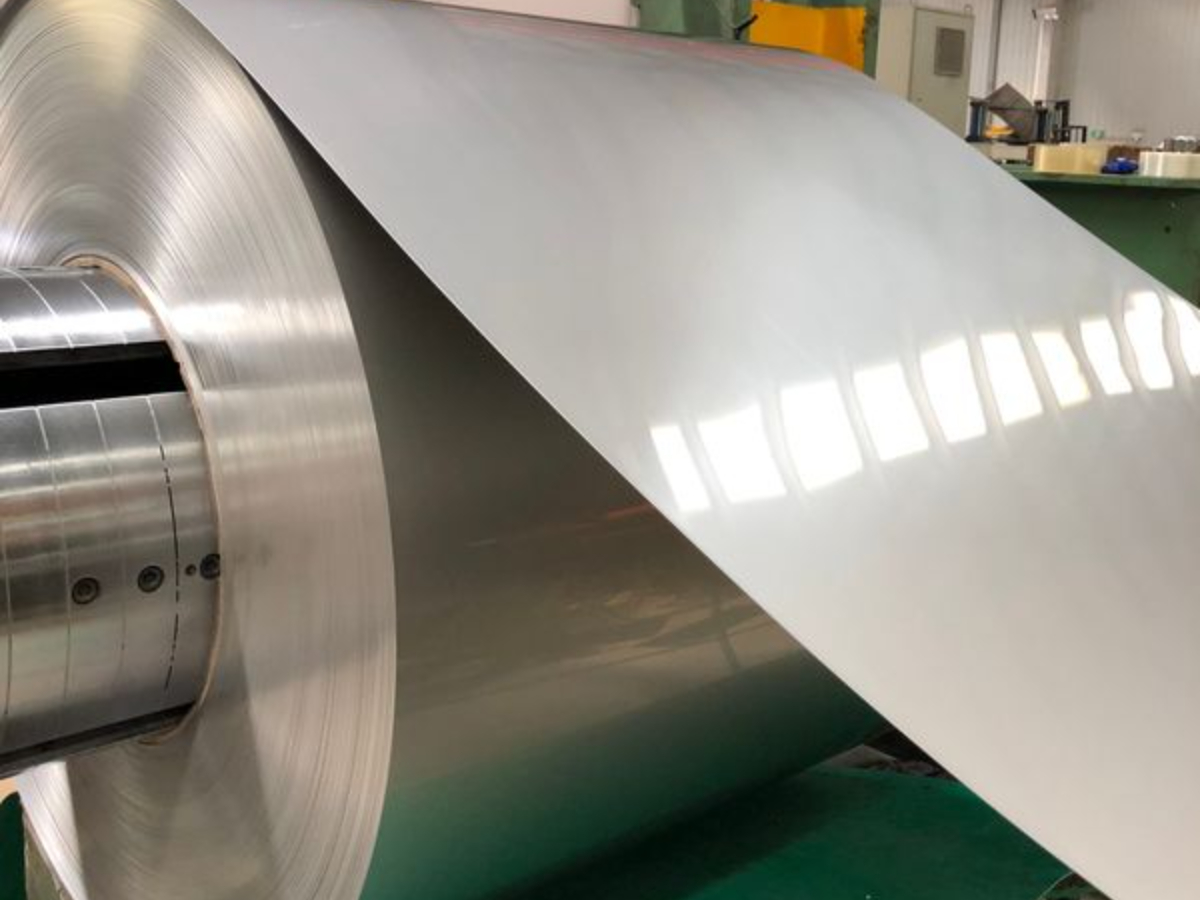

(If you want to know more about the industry news on stainless steel coil prices, you can contact us at any time)

In response to the problems of high cost and low demand, the state is also constantly regulating and reducing costs. With the regulation in place and the stimulus from the news, the current steel price has fallen from the previous high point, and the upcoming PPI data is also expected to enter the falling range, which will not rule out a certain boost to the sentiment.

(To learn more about the impact of specific steel products, such as 420j1 stainless steel coil, you can feel free to contact us)

In response to the problem of financial pressure, the implementation of the policy measures that have been determined will be accelerated in the near future, and incremental policy tools will be actively planned. In the short term, the policy is still expected to continue to exert force, and it is not ruled out that the slowdown of the data will appear, which will boost the market in stages.

(If you want to get the price of specific steel products, such as hot rolled stainless steel coil, you can contact us for quotation at any time)

In the short term, rebar futures in night trading still show signs of continuing to fall. In the absence of more obvious positive stimulus, it is not ruled out that the emotional side will be the first to recover after oversold. The Fed’s interest rate hikes will continue to hype in the periphery. Crude oil and other commodities brought about by geopolitical conflicts are still volatile, and crude oil that has a more direct impact has eased in the short term after being dumped, but the impact of geopolitical conflicts Still continuing, still insisting on the volatile market view unchanged, if the demand is lower than expected, it will still exacerbate the risk release.

Post time: May-09-2022