The rebound of ferrous metal futures failed, and there are still downside risks in the short term

The steel market continued to decline slightly today. At present, the enthusiasm for “production reduction” has declined, and the market has lost patience with the implementation of the production restriction policy.

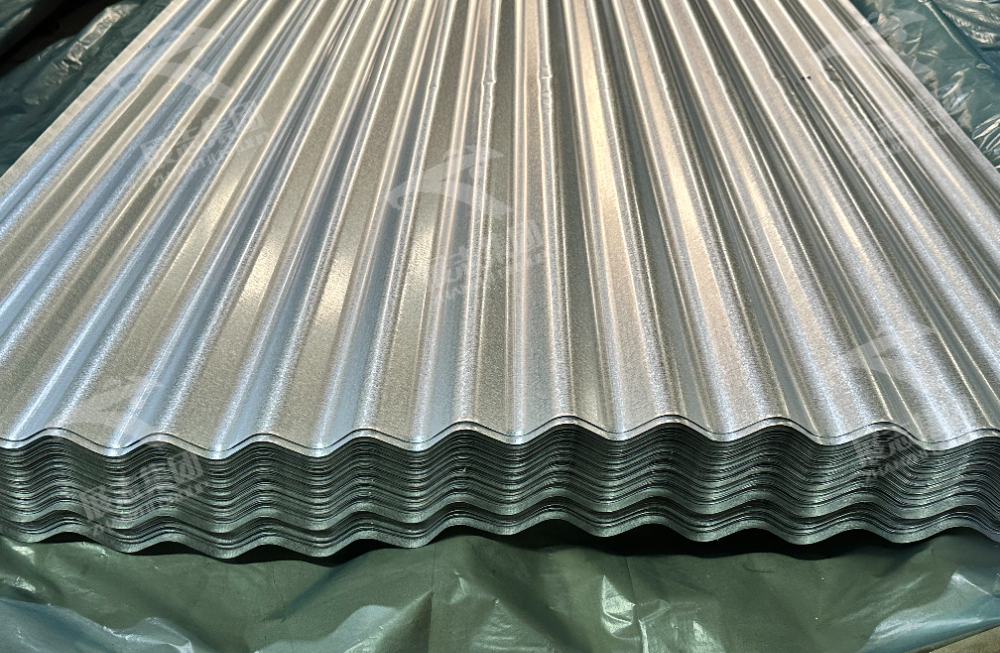

(To learn more about the impact of specific steel products, such as 14 Gauge Corrugated Steel Panels, you can feel free to contact us)

On the one hand, the rebound of steel prices in the past two days has been weak, and the trend of finished products is weaker than that of raw materials; on the other hand, the spot prices of coking coal and coke have risen, and the rhythm of steel mill replenishment has not changed significantly. Judging from these two aspects, steel mills have no sense of urgency to cut production.

(If you want to know more about the industry news on Galvalume Corrugated Metal Roofing, you can contact us at any time)

Fears of a “soft landing” have grown as the U.S. economy weighs heavily on debt. Fitch’s downgrade of the U.S. credit rating reflects an expected deterioration in U.S. fiscal conditions and a high and growing government debt burden over the next three years. At the same time, a large number of small and medium-sized banks have also suffered credit rating downgrades. Currently, US debt interest payments account for 14% of total government spending, exceeding the normal level of 5%-8%. If there is a credit crisis, it will still affect the global bulk market and spread to the black. But the logic for the market to trade a U.S. recession is not strong enough.

(If you want to get the price of specific steel products, such as Galvalume Corrugated Roofing Sheets, you can contact us for quotation at any time)

The current market is unstable, and the possibility of a decline is still not ruled out. The current market is weak and most importantly confidence is weak. The weak recovery has not yet seen a strong improvement, and it is difficult to reduce production, which has deepened market worries. This aspect needs to be improved upon demand. There is no need to be too pessimistic about demand, there will still be recovery.

Post time: Aug-11-2023