China Export:

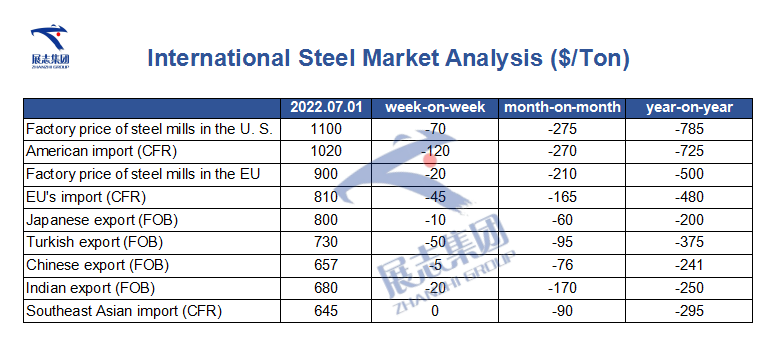

After a month of continuous decline in China’s HRC internal trade, the overall showed stability and rising this week. The leading steel mill has not yet been publicly reported, but is the bid relatively stable, and some low -cost resources have marginal calls. The price of SS400 HRC in the state-owned factory is basically at FOB 650-670 $/ton. Some steel mills are forced to maintain the export price at FOB $700/ton. The actual transaction level of traders is about FOB 640-650 $/Ton . The transaction price of low-cost resources in North China is FOB 720-740 $/ton. Due to the more competitive Russia and Indian resources, the export transactions of China’s hot rolls are still sluggish this week. (To learn more about the impact of specific steel products, such as Hot Dipped Galvanized Steel Sheet In Coils, you can feel free to contact us)

(To learn more about the impact of specific steel products, such as Hot Dipped Galvanized Steel Sheet In Coils, you can feel free to contact us)

Southeast Asia:

The regional market demand is weak. Buyers are watching and watching. The price of hot rolled steel coil and plate in Southeast Asia this week is consolidated slightly. At present, the mainstream import price of SS400 levels is CFR Southeast Asia 645 $/ton.

It is understood that a 30,000 ton SAE1006 -level increased boron hot rolled steel coil and plate from India to Vietnam, with a transaction price of CFR Vietnam 670 $/ton. A Vietnamese trader said that Tata Steel sold 60,000 tons of HRC to Vietnam at a price of CFR 670-680 $/ton.

It is understood that the Indian HRC offer this week to Vietnam at CFR 670-680 $/ton, and the Chinese HRC offer to Vietnam at CFR 660-665 $/ton. As the order sales rate in August reached only 50% to 60 %, Formosa Plastics Hejing will consider reducing production.

(If you want to know more about the industry news on Galvanized Steel Coils For Sale, you can contact us at any time)

India:

India is in seasonal off -season, market demand is small, raw material prices continue to fall, hot -rolled steel plate prices are under pressure, and buyers are watching. The price of hot rolled steel plates in India this week has been settled. The current price of the purchase of Mencius is 760 $/ton, and the weekly decreases by 20 $/ton.

In terms of exports, Indian HRC are greatly affected by tariff policies. In order to maintain export share, Indian steel mills choose to sell boron -containing hot rolls to avoid 15% of export tariffs. However, due to the limited availability of boron -containing materials, buyers are also interested in boron -containing hot rolls. At present, the export price of Indian HRC is FOB 680 $/ton, and it has fallen by 20$ per ton month -on -month.

In terms of imports, a 50,000-ton Russian HRC was sold to India at a price of CFR 645-650 $/ton .

Europe:

This week, the supply and demand of the European steel market has not been eased, the demand for the automotive industry is still weak, and high inventory levels suppress buyer’s purchase. Some local market participants believe that the price has bottomed out. With the recovery of the autumn demand, buyers will gradually resume their procurement in July, and expressed caution and optimism about the market outlook. At present, the EU’s mainstream hot roll price is 900 $/ton, and the monthly loop decreases 210 $/ton. The mainstream import price is 810 $/ton, and the monthly loop decreases 165 $/ton.

(If you want to get the price of specific steel products, such as Hot Dipped Galvanized Coil Price, you can contact us for quotation at any time)

In Russia, from the outbreak of Russia and Ukraine’s conflict, Turkey replaced Europe as the main market in Russia. Recently, Turkey’s demand has been sluggish. Previously, the price of waste steel continued to weaken. The Russian steel mill had to reduce the offer to match the lower psychological expected price of buyers. Due to the different degree of sanctions in Russia’s steel mills, the current price difference between steel quotation is large. At present, Russia’s hot-rolled plate export quotation is at FOB Black Sea 580-620 $/ton.

The U.S.:

The price of hot rolled steel plates in the United States has fallen sharply this week. In order to avoid cumulative inventory, buyers purchase cautiously to fill the inventory gap. At present, the factory price of the central and western United States is 1,100 $/ton, the monthly ring is 275$ per ton, the import price is 1020 $/ton, and the monthly ring fell 270 $/ton.

Post time: Jul-04-2022