Will the price of steel change again?

The most eye-catching thing in the black series last week was iron ore. On the one hand, the upward drive was stimulated by macro policies, and on the other hand, the apparent demand for steel products improved month-on-month. However, the price of iron ore itself is also facing continuous control pressure, which will also limit the height of steel price rebound on the one hand.

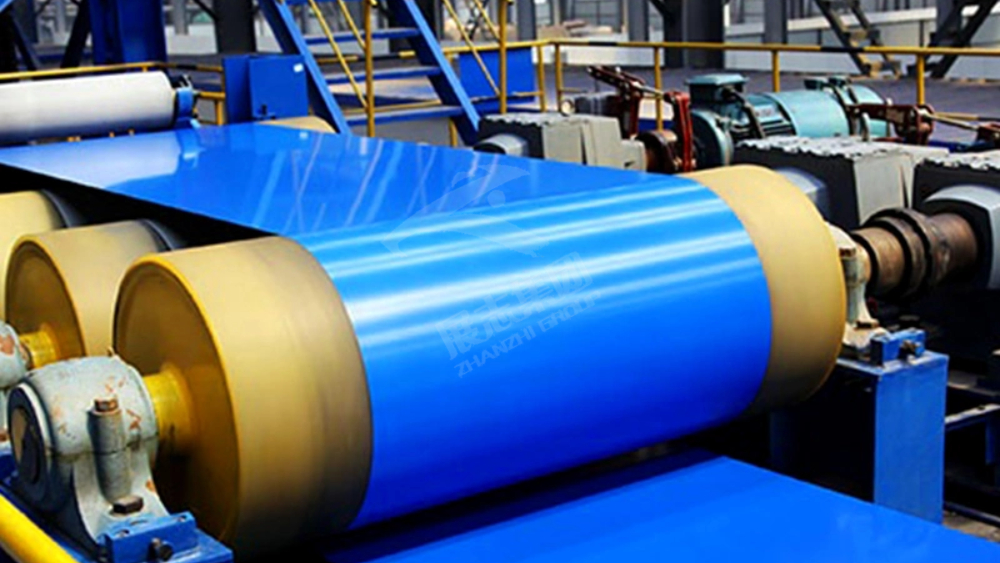

(To learn more about the impact of specific steel products, such as Ppgi Prepainted Galvanized Steel Coil, you can feel free to contact us)

1. The influencing factors of the steel market are as follows

1. The central bank: continue to implement a prudent monetary policy accurately and forcefully

2. The start-up rate of infrastructure construction rebounded and the “excavator index” rebounded

The inventory coefficient of auto dealers in March and May was 1.74

(If you want to know more about the industry news on Ppgi Prepainted Steel Coil, you can contact us at any time)

2. Spot market

Today’s hot roll: weak in a narrow range

At present, the terminal demand in the market is still weak, and the inventory structure is not good. At present, the profit structure of steel mills has been repaired, and the low output and low inventory situation give steel mills an expectation of increasing production. However, the order receiving situation of steel mills is still weak, and it is expected that the HRC shock will run weakly tomorrow.

(If you want to get the price of specific steel products, such as Ppgi Coil Price you can contact us for quotation at any time)

3. Raw material market

Today’s black series of snails fluctuated at a low green level after the opening of the market. Downstream steel enterprises’ sentiment to buy billets has been suspended, and billet stocks have rebounded slightly. The price of downstream finished products has been steadily reduced by 20-30 yuan/ton, and the overall transaction is weak. It is expected that the steel billet will be slightly lowered tomorrow.

At present, the operation of the blast furnace is stable, the average daily output of molten iron fluctuates at a high level, and the demand for iron ore is acceptable. However, before the off-season comes, the sustainability of iron ore is in doubt. The recent trend is mainly dominated by the macro, and we still need to continue to pay attention to the introduction of policies in the future. It is expected that iron ore will run at a high level and fluctuate tomorrow.

The production of coke enterprises is relatively stable, and the overall inventory pressure is not obvious for the time being. At present, the prices of downstream steel mills have been raised, and profits have been restored.

At this stage, the destocking trend of steel products is good, the overall level is not too high, and the fundamental contradiction is not big. In the near future, it is mainly due to the strong raw materials boosting the black industrial chain, which drives the steel futures to fluctuate and rise. However, if iron ore rises too fast, it will easily trigger a correction, and fluctuations in cost will increase fluctuations in steel prices. It is expected that steel prices will run steadily and moderately tomorrow, with a range of 10-30 yuan.

Post time: Jun-12-2023